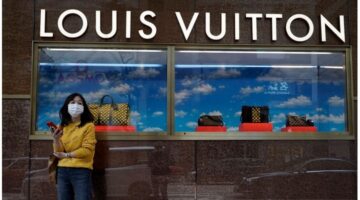

The Chinese consumer market is considered as the lion’s share in the luxury global market. But the virulent spread of Coronavirus 134769 cases around the world. For the international luxury industry, which relies heavily on Chinese shoppers, it’s already taking a financial toll.

The outbreak has dramatically reduced the number of shoppers in Chinese cities and made companies to shut stores. Travel restrictions also are curtailing the traditional flow of tourists to other destinations that sometimes host many visitors buying luxury goods. Chinese shoppers structure a few third of worldwide luxury spending, counting their spending inside and out of doors the country, consistent with management consultancy Bain & Company. That’s quite the other nationality.

To stop the spread of disease, travel to, from and within China has been curtailed. Stores are closed and even those that are open see a dramatic decline in pedestrian traffic . for instance, 150 out of Capri Holdings’ 250 China stores are closed, Ralph Lauren has closed half its 115 stores, and Adidas reports it’s temporarily pack up a “considerable” number of its 12,000 stores there.

The supply chain for goods beginning of China is additionally taking an enormous hit. Factories are traditionally closed for the Chinese New Year celebration, which this year was from January 25 through Groundhog Day, but in some regions, the shutdown has been extended through February 10, though it’s going to go longer depending upon the speed of infection.

But looking across China’s vast $14.3 trillion economies, Cowen’s Oliver Chen believes luxury brands are going to be the foremost impacted by the epidemic, as long as the businesses he covers depend upon China for a mean of 14% in revenues.

In particular, LVMH (17% of revenues) and Tiffany (17%) are most in danger, with Richemont (11%), Tapestry (10%), honker (10%), and Capri Holdings (6%) having less exposure there.

Farfetch is additionally heavily hooked into China, accounting for 28% of its business, but because it’s an e-commerce company, it won’t likely suffer the maximum amount as other brands relying upon in-store sales. Noting that wealthy Chinese consumers are within the habit of flying into luxury shopping capitals of the planet to form opportunistic purchases, Gandhi sees this halted, albeit people can get a flight out of the country. “Nobody’s getting to get on a plane and risk their health to shop for something.”

For some purchases, particularly the very high-end segment, he expects those purchases are going to be deferred and are available back once travel bans are lifted. except for cheaper luxury, like trend-driven fashion, those sales are lost permanently. “It’s an entirely different purchasing cycle.”

Most are relying on the Chinese luxury consumers to return roaring back after the pandemic subsides driven by pent up demand and therefore the symbolic meaning luxury brands hold for them.

“Luxury goods in China represent a way of accomplishment both at a private level but even more importantly, pride within the nation,” says the Jean Baptist Voisin who is the global strategist at LVMH. “While I’m not a psychologist, I hypothesise that the demand for luxury will increase once this ends.”

That is assuming that the consumers on which the posh market depends have jobs and remain willing to spend their income on luxury indulgences.